The Market Overview

From Late February onwards I was sending regular email reports to all clients regarding the Market downturn.

My stance from the start was that markets would definitely recover but I would not be able to put a date on when that would be. This downturn was nowhere near as severe as the 2008 “credit crunch” which at its worst saw the FTSE 100 index fall by 51%. The “Covid Crunch” was relatively short lived, the UK market fell by 38% between Mid-February and its lowest on March 24th but was extremely volatile seeing markets fall by 11% in a day and then rebound by 9% the following day. We then saw this amazing V shaped recovery in the markets that even I did not expect and if anyone had told me where we would be today back in March I think I would have directed them to the nearest Psychiatric department!

Extremely low interest rates and inflation have played a part, as has Quantitative Easing (QE), which is a monetary policy whereby a central bank buys government bonds or other financial assets in order to inject money into the economy to expand economic activity. It is an unconventional form of monetary policy, it is usually used when inflation is very low or negative, and standard expansionary monetary policy has become ineffective. Other government stimulus methods including the Furlough Scheme have played a part without a doubt.

The China Index and South Korea fell the least and have completely recovered. The American Markets are almost there as are some European indexes such as Germany are also very near. The UK has still got a way to go though and the FTSE 100 especially has unique issues as almost 2/3rds of this index actually trades in foreign currency (mostly US Dollars) so has a tendency to be effected by currency fluctuations. Good quality funds have outperformed markets by some way since the downturn and if you invest in an actively managed fund and you are not getting better than market growth you need to ask your adviser or the fund manager why, because you are paying management fees to these people and need to see value for that.

The short term future? You can never second guess the markets in the short term but if we end up getting this elusive Brexit deal markets will certainly go up sharply and of course a successfully rolled out vaccine is bound to do the same. No deal may see modest falls but my feeling is that this is already priced in.

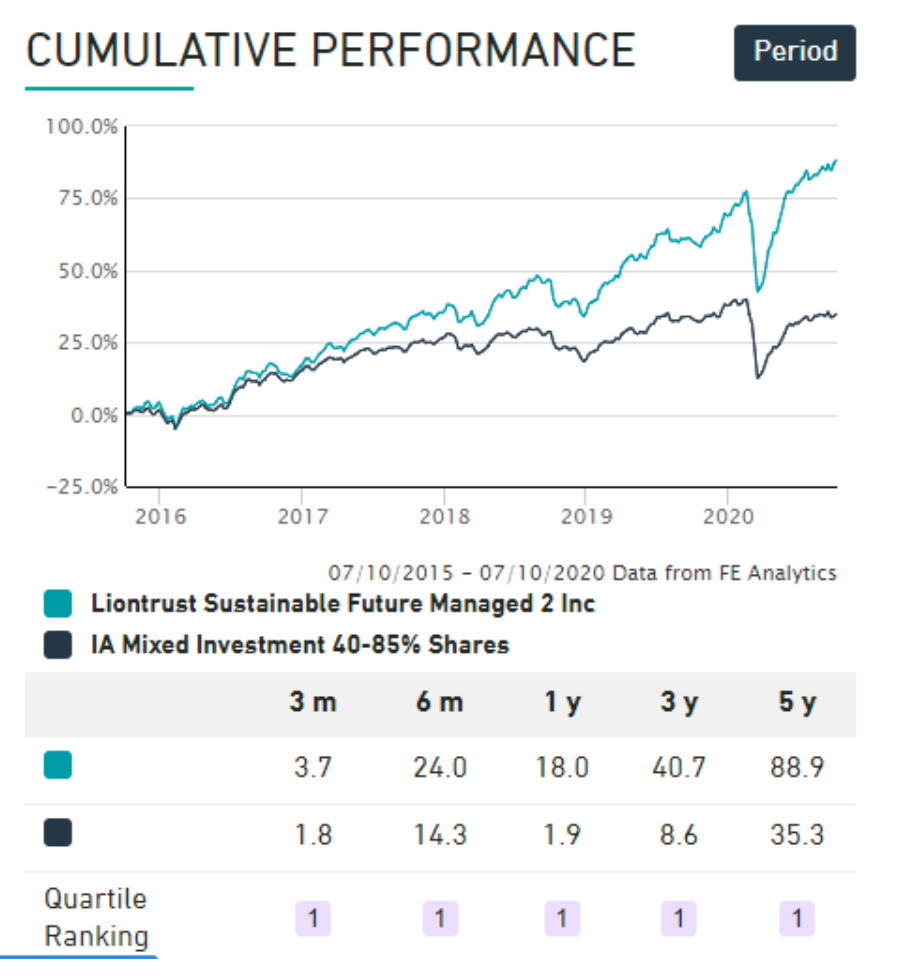

The best and worst performing funds tend to be funds with narrow themes such as technology which is booming at present. Technology is high risk and can be volatile so be aware of that, Latin American funds and Equity Income funds are struggling and should be avoided for the time being. One of my favourite funds is a multi-asset fully actively managed fund (holding shares, fixed interest and cash) which invests purely in ethical companies, the Liontrust Sustainable Future Managed fund, which has grown by 18% in the last 12 months. For more information and to discuss if this is suitable for your needs ring me for a chat or mail me through the contact page.

Disclaimer

Third party content and links to external websites

We are not responsible for the content of any linked website in our blogs or on our site. and cannot take responsibility for the consequences of your using the information or services on linked websites. A link to a third-party website does not imply endorsement – you must use your own judgement to decide whether the information or service on that website is suitable for your needs.